How to start your new Job as Sales or Business Development Manager right?

- Manuel

- Jun 4, 2025

- 5 min read

Updated: Jun 20, 2025

I have been there several times. You get promoted or change your employer for a new position. When you arrive as e.g. the new head-of sales or business development there will be many things you need to understand quickly. Once I´ve been inbetween to jobs of sales management and I decided to create a framework for my self, how to start into this position right.

I want to share this one with you here for the first phase of analysis. The phase of understanding which, in my opinion, is the most critical. If you do this wrong or forget the understand major topics you simply increase your chance to fail.

First note: Leave the office! Talk with customers, direct reports, peers, competitors, suppliers, partners, your network….

This implies that first thing you do is analyzing your main stakeholder.

Be super proactive! Don´t accept to delay this process due to time conflicts, internal meetings or bad time management. Set clear expectations e.g. for your reports for customer meetings, pull actively information from other departments. Overall the analysis should not take longer than two months.

The analysis based on this framework will be done in six steps:

1. Analysis of the market environment: Branch analysis and macrotrends

As stakeholders are identified and analyzed already, we start with market environment.

Target: Understand how external trends and streams impact your market

Approach: PESTEL Analysis

Following I created and “high level” example of a project where a German industrial company wanted to expand to USA. The analysis was made some time ago and this shows one weakness of the PESTEL è it´s quite static.

To make the analysis a bit more dynamic you could use a visualization like below with a continuous update.

Next, analyze your addressable market. Method: TAM – SAM – SOM

2. Internal organization

This is about your team, existing processes, systems in use, available data quality, and performance. First get an idea of the current organizational structure, processes in place for existing roles and responsibilities:

How is the current sales process defined

Cross-functional interfaces, e.g. lead generation to opportunity management, internal to external sales, sales to service or customer success, Q-line management to order management, marketing to sales

How do they track existing opportunities, how do they forecast, how does the current funnel look like

How´s the current sales reporting

So, there is a lot to understand in this second step. That´s why I recommend the following process:

Sales Process Analysis

Analysis of Systems and Workflows Used Within These Processes

Sales Roles, Team Competency and Personality Profiles This is about your team. If you want to dive deeper in the imporant topic of sales roles and the right hiring profiles read my blog post about the sales hiring profiles

Analysis of Current “Cultural Norms” in the Team Structure This includes:

Hard facts: Employment contracts (commission structures, working hours), workflows for personnel requests (vacation requests, sick leave, childcare, office supplies), and meeting structures (frequency, timing, and format of team meetings).

Soft facts: Personal preferences and aversions among team members, past successes that the team takes pride in, and “sacred cows” that should not be challenged immediately, opinion leaders…

Analysis of Current Performance Management and Forecasting

Pricing and Cost Structure

As a final step you put all your internal analysis in a SWOT Analysis.

3. Customer Analysis

Start by analyzing the current customer portfolio. This could be a slightly modified VARIO analysis. We can say that, fundamentally, a VARIO analysis should be conducted here. However, I believe that the exact choice of column names should be kept somewhat flexible and adapted to each company as needed. Now we are getting fundamental. The most important question of your customer analysis might be the one about their problem, challenge vice versa your CVP (customer value proposition). There are several studies to map customer needs. One is from BAIN & Company. Explore the B2B Elements of Value - Bain & Company Interactive Graphic.

Another one is a tool kit focusing on 8 needs which I got trained on during my sales transformation training program in the past:

Keep your CVPs as simple as possible otherwise they won’t find execution in the sales process.

Now it’s time to analyze your buyer´s journey which is essential to define your sales process based on the GTM strategy. We´re now at a point where we combine multiple analysis which we have done so we will take it step-by-step.

You are know able to map a matrix of your buyer´s personas challenges, their CVPs along their buyer journey.

4. Sales Channel Analysis

Most probably you will do the channel analysis simultaneously with the customer portfolio analysis.

Direct Sales

Field Sales / Outbound Sales

Account Management

Tele-Sales / Inside Sales

E-Commerce / B2B Portals

Two-Sided B2B Platforms

OEM (Original Equipment Manufacturer)

White Label

Indirect Sales

Distributors / Resellers

Value-Added Resellers (VAR)

Managed Service Providers (MSP)

Contractors

Consultants / Consortia / Industry Networks

5. Analysis of your Competitors

In general, we should aim not to focus too much on our competitors but rather work on ourselves. Our primary goal must be to make progress every day and to be better each week than the week before. An excessive focus on the competition is often counterproductive.

However, it still makes sense to start by getting an overview of market players and their positioning. This can be as simple as creating an overview of competitors, their sales models, strengths/weaknesses, and key focus segments/industries/customers. Alternatively, you could also conduct a Porter’s Five Forces analysis, which examines the competitive landscape in a broader context.

Actually, this analysis complements our previously conducted PESTEL analysis very well.

6. Social Networks and Strategic Alliances

How good are we with this? So important but often not consider enough. Social networking has become so important as buyers are well informed and busy nowadays. So outbound sales are getting harder and harder. You need to make the buyer find you è focus on inbound sales.

Utilizing networks to gather and exchange information

Generating ideas and improvement suggestions

Creating access to market information

Establishing collaborations with companies, competitors, universities, and research institutes

Creating signaling effects è inbound lead generation

Building shared values ("shared values")

Recruiting evangelists

Building business contacts

Active participation in social networks (creating content, openly exchanging information)

Establishing strategic partnerships with customers, investors, or multipliers such as consulting firms, auditors, planning offices, general contractors, EPCs, etc.

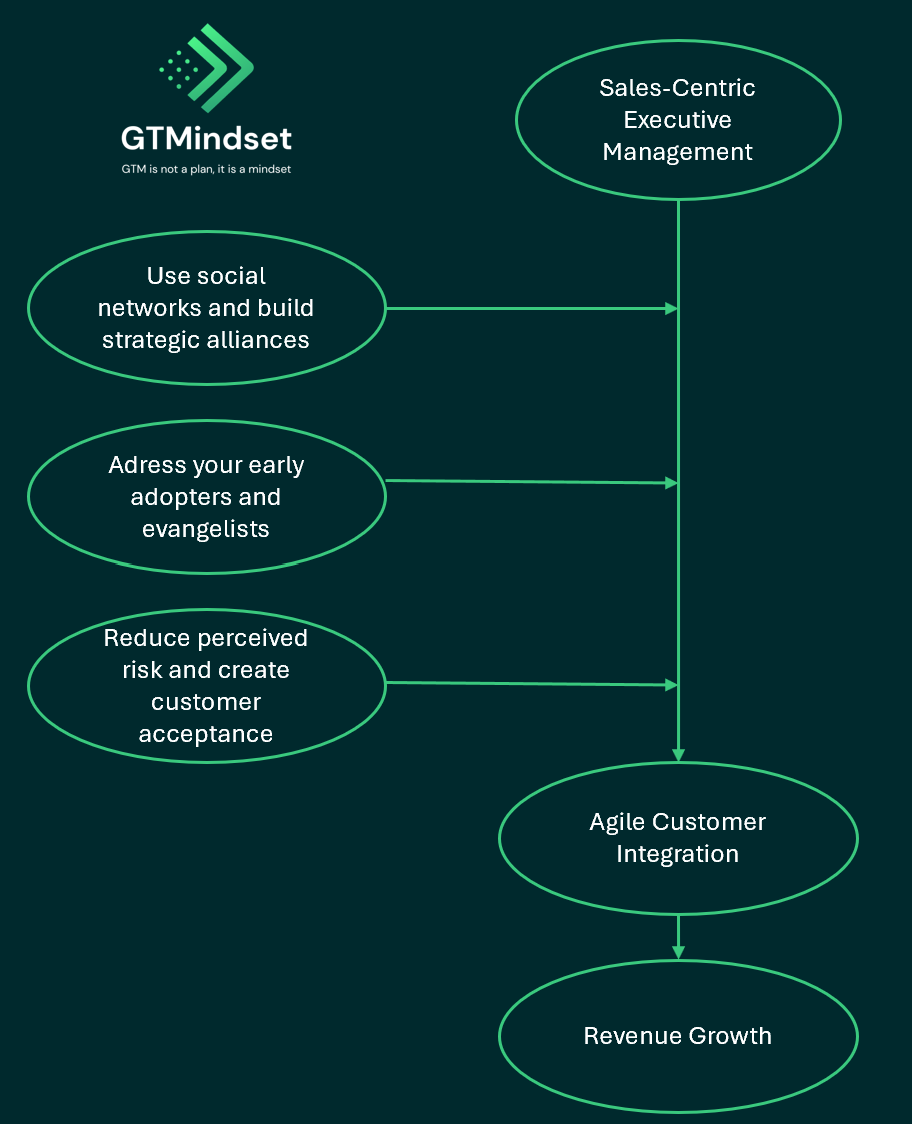

As a result and summary I prepared a visualization of this framework which should help you to have in one quick overview all the topics you should understand within the next weeks.

Comments